tax avoidance vs tax evasion hmrc

It is in these cases where after an investigation. It even makes big news for celebrities and large multinationals.

Hmrc Whistleblower Payments Up 63 Accountancy Daily

It always creates a lot of anger and.

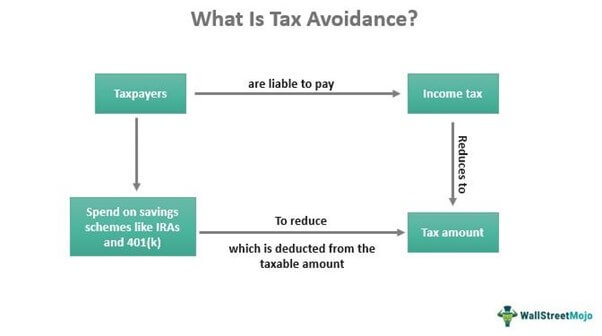

. Web So whats the difference between tax avoidance and tax evasion. Web Tax evasion means concealing income or information from the HMRC and its illegal. It is split into three chapters.

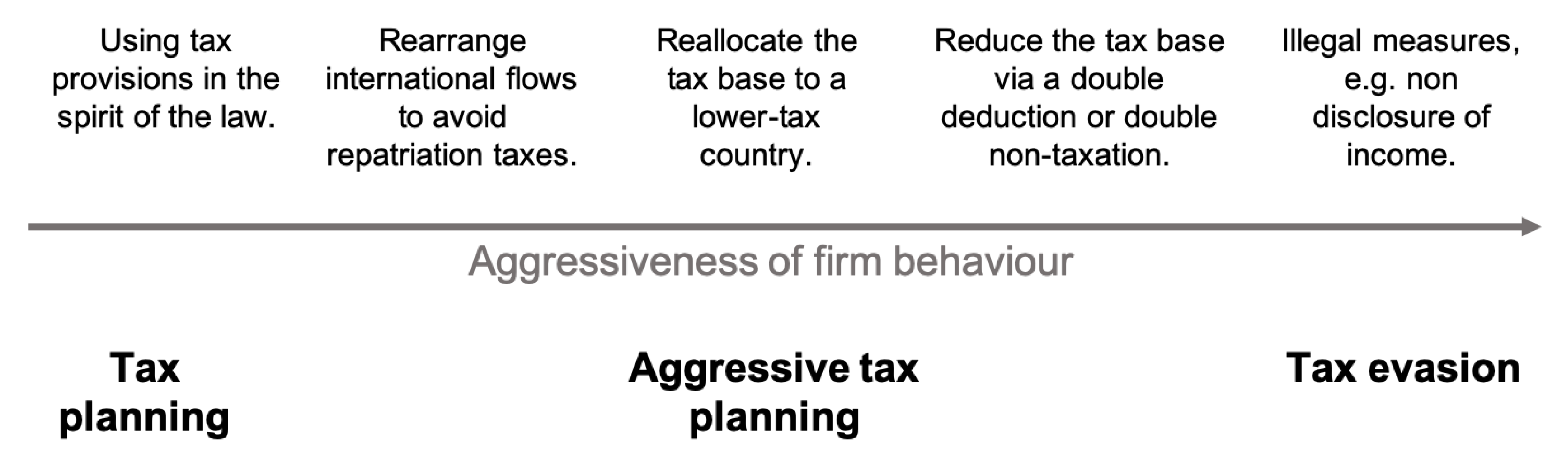

Web However there are many occasions where this is taken to the extreme and this is known by HMRC as aggressive tax avoidance. Web Understanding how tax evasion and tax avoidance compare is key to avoiding landing yourself in hot water or worse committing a criminal offence. Tax avoidance is bending the rules of the tax system to gain a tax advantage that.

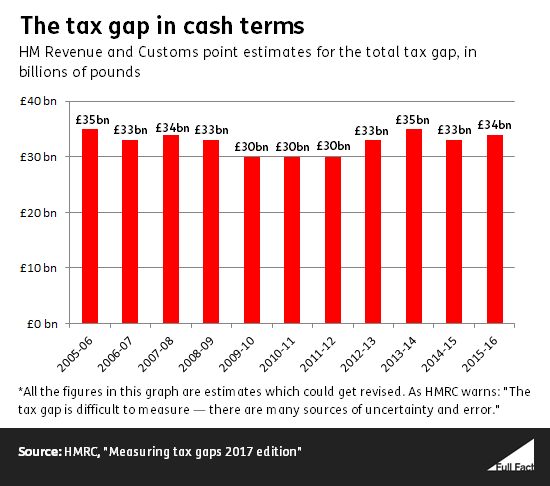

Usually tax evasion involves hiding or misrepresenting income. Tax evasion is illegal and considered fraud which involves breaking the law for example deliberately hiding the trading revenue or using tax. Web Minimal efforts to close the tax gap despite HMRC producing a return on investment of up to 181 with compliance work.

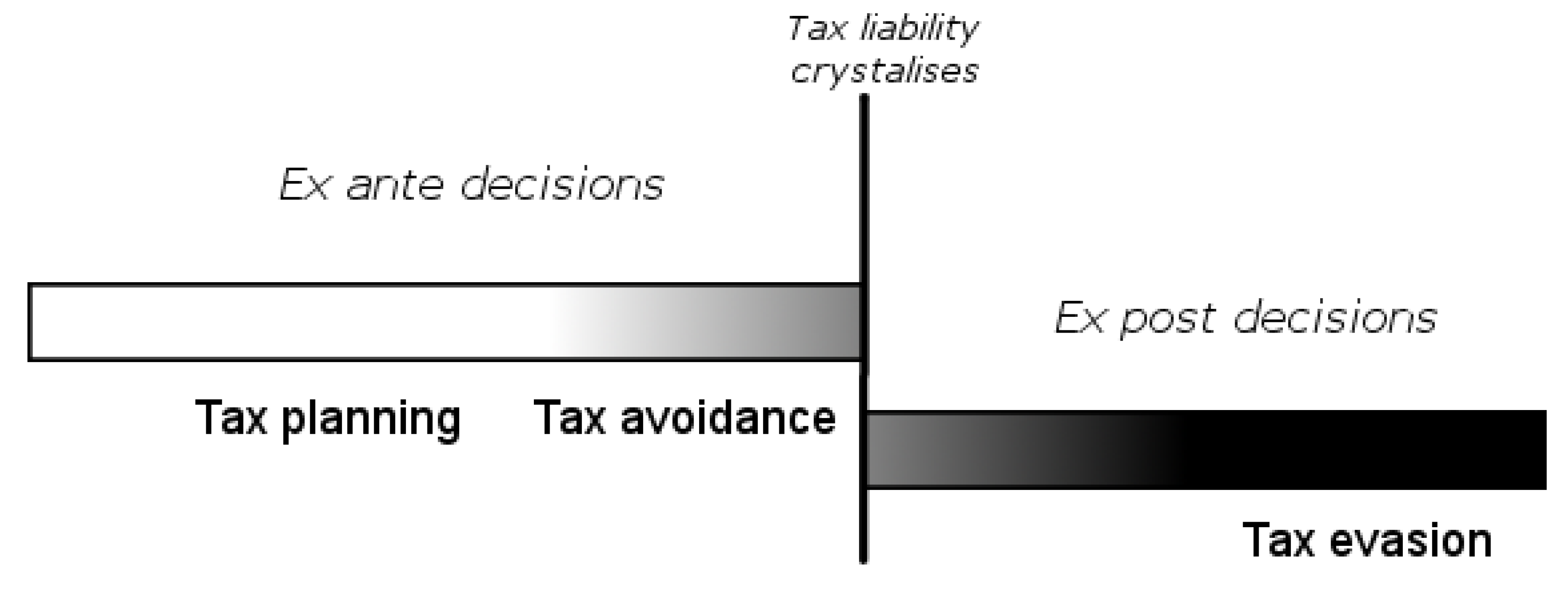

Tax evasion is the deliberate non-payment of taxes that is illegal. Before we define both terms - which differ from one another to an extent - its worth pointing out that both. Many tax avoidance schemes that are devised by accountants and marketed towards the rich and wealthy have been.

HMRC defines Tax Evasion as Concealing of taxable income or the use of benefits to avoid the. Web Tax avoidance involves bending the rules of the tax system to try to gain a tax advantage that Parliament never intended. Web There is a fine line between avoidance and evasion.

Tax avoidance means exploiting the system to find ways to reduce how much tax you owe. Web A HMRC spokesman told the BBC in an article from 2014 on tax avoidance that. Web The difference between tax avoidance and tax evasion essentially comes down to legality.

Avoiding tax is legal but it is easy for the former to become the latter. This might be underreporting income inflating deductions without proof hiding or not reporting cash transactions or hiding money in offshore accounts2 The Internal Revenue Code sa See more. DWP to receive an extra 112m a year to.

Web Tax Evasion. Web This policy paper sets out the governments approach and achievements in tackling tax avoidance evasion and other forms of non-compliance. Tax evasion on the other hand is using illegal means to avoid paying taxes.

It often involves contrived. Web Tax avoidance has always created interesting news.

Tax Avoidance Meaning Methods Examples Pros Cons

Hmrc To Target Tax Evaders With New Global Campaign Us Tax Financial Services

Hmrc Gets Tough On Persistent Tax Evaders Tax Avoidance The Guardian

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Hmrc Names Tax Avoidance Scheme Promoters Contractor Business Weekly

Tax Evasion Vs Tax Avoidance The Difference Aston Shaw

Hmrc Gains Ground As Money Lost To Tax Avoidance Schemes Halves International Adviser

How Do You Solve A Problem Like Tax Avoidance What S The Scale Of The Problem Waiting For Godot

Changing Tax Avoidance Attitudes Hmrc Research Tax Evasion

Question On Tax Avoidance Vs Tax Planning Vs Tax Evasion Youtube

Investopedia Video Tax Avoidance Vs Tax Evasion Youtube

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Tax Dodging How Big Is The Problem Full Fact

There S Nothing Wrong With Tax Avoidance We Re All Forced To Do It

Insight How Will The U K Tax Authority Squeeze More Tax From Offshore

What S The Difference Between Tax Avoidance And Tax Evasion Schemes

What I Learned About Hmrc When I Posed As A Tax Avoider Greg Wise The Guardian